Table of Content

By doing so, you take the chance of losing out on the investment and your home. Taking this risk may not be a path worth going down — the stock market isn’t always stable. Home equity loan and line of credit rates went up slightly last week.

Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. For personal advice regarding your financial situation, please consult with a financial advisor.

Second Mortgages

So put on your big kid britches and get to work saving money so you can afford the things you want and feel good about them. Even if you repaid part of the loan, the bank can’t just saw off the master bedroom so you can keep the part of the house you own. So basically, your home equity is the part of your home you own. You build more home equity as you pay down your mortgage and as your home’s value goes up. For example, rapidly rising home prices are contributing to a significant equity increase for homeowners with mortgages across the country. According to data provided by CoreLogic, these homeowners have amassed nearly $3 trillion in equity growth since the second quarter of 2020 — up 29.3% year over year.

A home equity loan functions much like a mortgage where you’re provided a lump sum up at closing and then you begin repayment. Every month, you’ll make the same payment amount, which is a combined principal and interest payment, until your loan is paid off. In the first half of the loan, you’ll make interest-heavy payments and then principal-heavy payments in the second half — this is called amortization. Home equity loans and HELOCs allow you to access your home’s equity without changing your primary mortgage’s interest rate.

Recap: How mortgage interest rates have changed this week

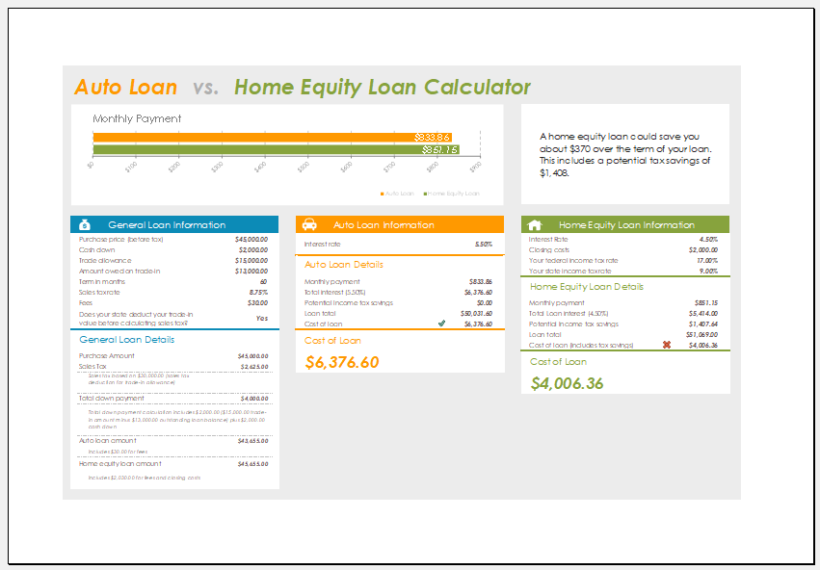

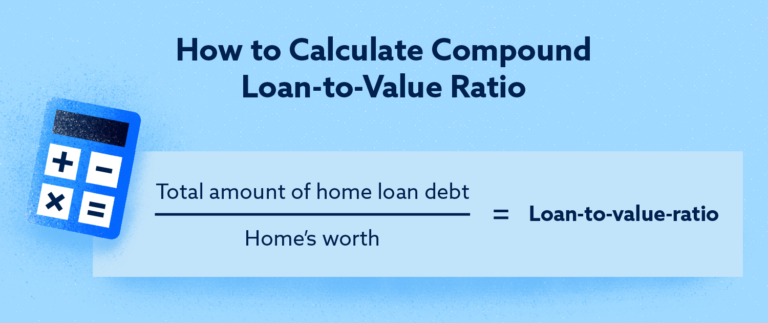

For well-qualified borrowers, the limit of a home equity loan is the amount that gets the borrower to a combined loan-to-value of 90% or less. For example, someone with a home that appraised for $500,000 with an existing mortgage balance of $200,000 could take out a home equity loan for up to $250,000 if they are approved. Rates assume a loan amount of $25,000 and a loan-to-value ratio of 80%. HELOC rates assume the interest rate during credit line initiation, after which rates can change based on market conditions. Obtaining a home equity loan is quite simple for many consumers because it is a secured debt.

The lender changes up the terms of your loan, such as your interest rate, right before closing, under the assumption that you won't back out at that late date. A home equity line of credit typically allows you to draw against an approved limit and comes with variable interest rates. Suppose your home is valued at $300,000, and your mortgage balance is $225,000.

Jobs and Making Money

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. There are multiple key differences between a home equity loan and a HELOC. In a nutshell, a home equity loan is a fixed, one-time lump sum that is issued and then repaid over time.

Here are a few of the key advantages and disadvantages of home equity loans. Most lenders will allow you to borrow up to 80% LTV, but some will let you go as high as 90%. You put down $30,000 when you bought it and since then, you have paid $30,000 in mortgage principal. That means you have $60,000 in equity ($300,000 home value minus $240,000 still owed). Each week, you'll get a crash course on the biggest issues to make your next financial decision the right one. When borrowed intentionally, a home equity loan or HELOC can be a great financial tool to help you achieve your goals in 2023.

How Do Lenders Calculate Student Loan Payments

Home equity calculator can give you an idea of what your home is worth and how much equity you may have if you’re thinking about selling your home or borrowing a chunk of your equity. If you decide to sell your house, you’ll have to make enough from the proceeds of the sale to settle both your first mortgage as well as your home equity loan. This could leave you with very little—or even zero—cash proceeds from the transaction. If you end up needing more money than what you borrowed with a home equity loan, you’ll have to apply for another loan. In this case, it might be better to go with a revolving credit line that allows you to repeatedly borrow, such as a HELOC. A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash.

With a HELOC, there’s an additional risk that rates could rise to the point that you can’t afford your monthly payment. Home equity loans are cheaper because they use the equity that you have in your home as collateral. While there are many risks to taking out a home equity loan, the biggest risk is losing your home to foreclosure if you can’t afford to pay your home equity loan back. See our current mortgage rates, low down payment options, and jumbo mortgage loans. A home equity loan is lent in a lump sum, and you repay the amount in flat monthly installments throughout the life of the loan.

That’s why we teach people to put at least 10–20% down when buying a home and then pay that sucker off as fast as possible! The borrower is slave to the lender, so you want to get out of debt quick. With a cash-out refinance, you owe the amount left on the original mortgage—and you borrow more money against your home’s equity. So, you’re basically going backwards and defeating the purpose of refinancing, which is to get out of debt quicker. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. These rates come from a survey conducted by Bankrate, which like NextAdvisor is owned by Red Ventures. The averages are determined from a survey of the top 10 banks in the top 10 U.S. markets. Consolidating debt can help you save monthly and in the long-term, but you’ll want to check the math carefully, because everyone’s financial situation is different. You can typically find home equity loans for anywhere from five to 30 years, depending on your needs and financial situation.

Compared to a shorter term, such as 15 years, the 30-year mortgage offers lower, more affordable payments spread over time. Like a traditional mortgage, a home equity loan is an installment loan repaid over a fixed term. Different lenders have different standards as to what percentage of a home’s equity they are willing to lend, and the borrower’s credit rating helps to inform this decision. Because home equity loans use your home as collateral to secure the loan, it’s important to weigh the pros and cons of this type of borrowing carefully. A home equity loan could be a good idea if you use the funds to make home improvements or consolidate debt with a lower interest rate.

If you have a business that requires more capital to grow, you might be able to save money on interest by taking equity out of your home instead of taking out a business loan. For some couples, it might make sense to take out a home equity loan or HELOC to cover wedding expenses. According to The Knot’s Real Weddings study, the average cost of a wedding in 2021 was $28,000, up from $19,000 in 2020. “This is another very popular use of home equity, as one is often able to consolidate debt at a much lower rate over a longer-term and reduce their monthly expenses significantly,” Hackett says. However, the right type of loan depends on your needs and what you plan to use the money for. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

A second mortgage is when you sacrifice your own home equity in exchange for a faster way to pay for things like home improvement projects or other debts. Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Then you have to pay back some of what you owe before you can spend more. Speaking of years, that’s how long repaying your home equity loan takes—anywhere from five to 30, to be exact.

No comments:

Post a Comment